Sem resumo de edição |

Sem resumo de edição |

||

| Linha 52: | Linha 52: | ||

** Video will be 66% until 2015 | ** Video will be 66% until 2015 | ||

** Mobile devices: 5 billions | ** Mobile devices: 5 billions | ||

[[Arquivo:ngh.png]] | |||

<br> | <br> | ||

Edição das 15h18min de 31 de maio de 2012

- http://www.rcrwireless.com/americas/20120221/carriers/reality-check-eight-brazilian-telecom-issues-to-watch-while-the-market-boosts/

- Maria Luiza Kunert (USP)

- Anatel, Ericsson, NEC, Vivo, Agilent, ...

- No. 1 – Mobile payments and NFC

- No. 2 – More than 50 million mobile broadband devices

- Number of mobile broadband-capable connections grew more than 23%

- Hitting 20.7% of the Brazilian device market

- The market ended December with less than 17% share

- In 2011, brazillian mobile broadband market increased more than 82%

- Anatel: 18.6 million new devices

- 242.23 million accesses by the end of 2011

- No. 3 – The beginning of mobile virtual network operators

- MVNO: wireless communications services provider

- Don't have the own the radio spectrum or wireless network infrastructure

- MVNOs: operation start in Brazil

- Porto Seguro and Virgin Mobile/Datora: two first MVNOs

- Can use the MVNE

- No. 4 – LTE Is a reality

- No. 5 – Converged services

- Quad-play: mobile voice and data, fixed broadband, wireline voice and pay-tv

- Signature: four contracts, one to each service

- Complaint: to phone four distinct call centers

- VoIP: Regulaments

- NGN => IMS

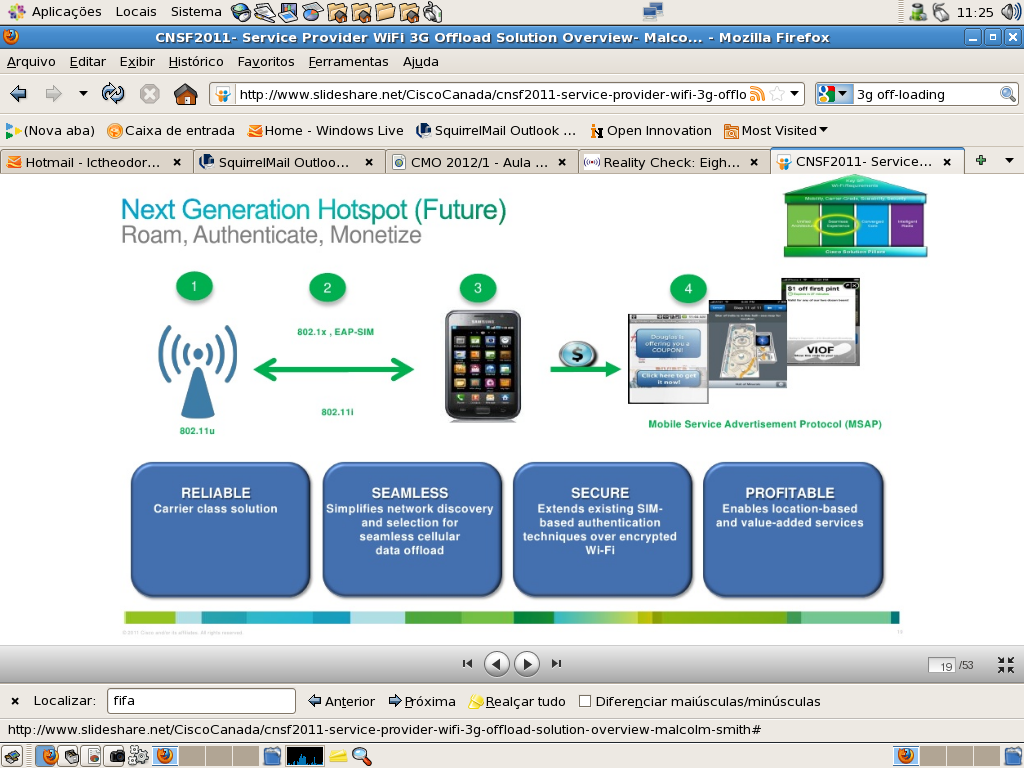

- No. 6 – Wi-Fi offloading

- Oi, Tim and Claro: plans to implement Wi-Fi hot spots to offload data from their 3G networks

- Reasons: costs associated with spectrum licenses and infrastructure

- Main objective: to relieve data traffic from 3G networks that are facing congestion problems

- Global Mobile Traffic will grow 26x (to 6.3 EB/Month)

- Video will be 66% until 2015

- Mobile devices: 5 billions

- No. 7 – Fiber, fiber, fiber and more fiber

- No. 8 – Cloud for mobile carriers

- References:

- www.networkessolutiionsforum.com

- Agilent